This comprehensive guide explores the critical role of selecting replacement properties and offers expert strategies for identification, while shedding light on common challenges, financing options, and the legal and tax considerations that underpin this powerful tool for growing and diversifying your real estate portfolio.

Table of contents

- Introduction

- Delayed Exchange Fundamentals

- Selecting Replacement Properties

- Legal and Tax Considerations

- Case Study

- Conclusion

- Additional Resources

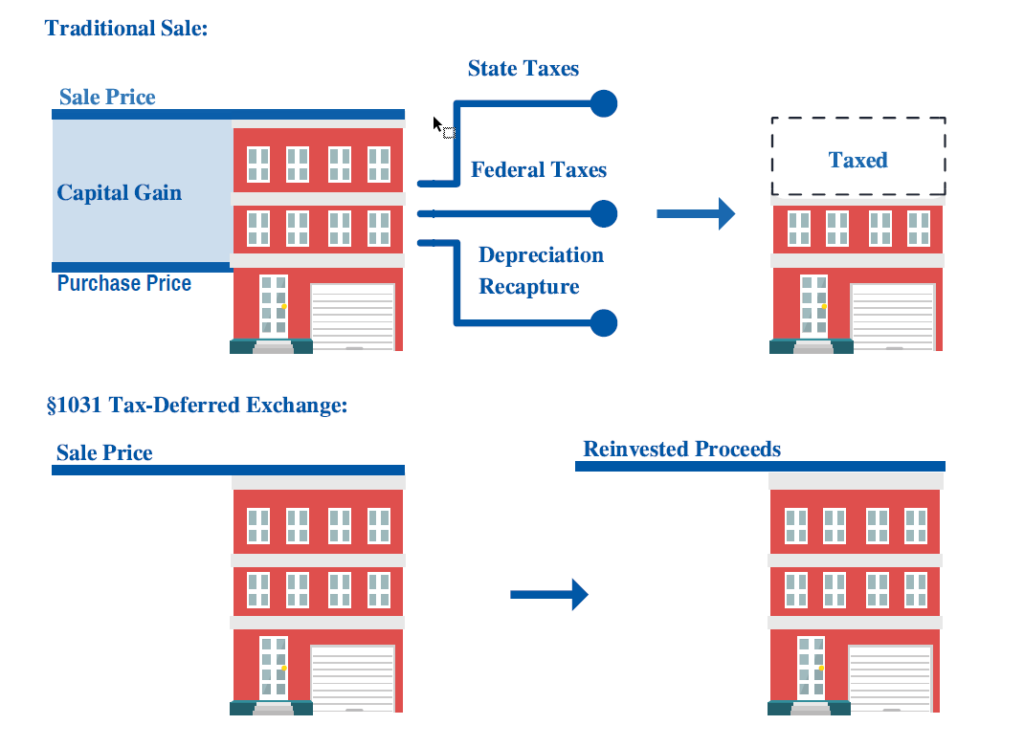

Understanding 1031 Delayed Exchanges

A delayed exchange is a type of 1031 exchange where the taxpayer relinquishes or sells a property, but is not prepared to simultaneously exchange into another property. The Delayed Exchange option allows the taxpayer up to 45 calendar days to identify replacement property and a total of 180 calendar days to purchase the replacement property and complete the exchange.

The Role of Replacement Properties

Selecting a property you plan to HOLD for investment is crucial. Most tax professionals recommend holding the property for 2 years to satisfy safe harbor. If your plan is more short term the property likely wouldn’t qualify for the exchange. For example, flipping properties or buying properties with the express goal of reselling them is expressly prohibited.

Strategies for Identifying Replacement Properties

The official identification will be in writing to your Qualified Intermediary (ERI) or to another ‘qualified party’. This official written identification is due by the 45th day following the close of the relinquished property. We are frequently asked, “How soon can I identify my replacement property?” Feel free to start your property search at any point (even before you’ve accepted an offer for the property you are selling). There is no restriction on when you find your replacement property or even when you make an offer. The exchange only cares about the order in which the properties close. For a Delayed Exchange you must close on your relinquished property BEFORE closing on your replacement property. You CANNOT be on title to both properties at the same time, if that is a possibility, you may want to consider a Reverse 1031 Exchange.

Market Research:

Understand your purchasing power (including mortgage payment) and the rental market you are purchasing in. Don’t put yourself in a situation where you have to come out of pocket to cover the mortgage and any incidentals because you cannot rent the property for what you were hoping to rent it for. But also, don’t be afraid of purchasing a property where you might only net $100-$200 after you cover the mortgage. Maybe you set aside any profits for the care and maintenance of the property and that means you don’t actually walk away with any income. Either way, you need to know your market.

Working with Real Estate Professionals:

Realtors can be an amazing asset. They know the area and the market because they are immersed in it every day. They can tell you the hot neighborhoods for rentals. They can tell you what neighborhoods are trending and up and coming. Working with a savvy agent can be key to your success.

Networking/ 3rd party support:

Maybe you weren’t planning to do an exchange, maybe you have a business and the owner of your offices or warehouse came to you with a chance to buy the building and become your own landlord. You could sell some rental properties and exchange into this saving you a whole lot in taxes and long term, you now own the building your business operates in which allows you more flexibility in your business.

Criteria for Selecting Replacement Properties

Purchasing and holding properties is what the exchange is all about. You decide what that means for you. Are you holding the properties to build equity and grow wealth, or are you only looking for properties to boost your monthly income? Sometimes you can find properties that fit both, but being aware of your needs as the investor is certainly the place to start and will guide you as you decide what replacement property is right for you.

Common Challenges

The biggest hurdle is locating the replacement property and any back up options within the allotted time. Never ask, “would I live here?” ask “would someone else live here?” The biggest mistake the average investor makes is trying to purchase a property that they would live in. In theory that sounds nice, but in reality – as an investor, you have to put yourself in the shoes of your potential tenants. Does a retired widow on a fixed income or a college student want to pay a rent bill that’s inflated because of granite countertops and stainless-steel appliances? No, they want a clean, working kitchen. They want a safe place to live. So don’t worry about upgrades unless you realistically think your tenant is going to be some wealthy wall street trader or some other professional who is willing to shell out for that sort of bling.

Financing Your Replacement Property

In an exchange, as a buyer you are not limited when it comes to financing options. When it comes to purchasing your replacement property your financing could be:

- Traditional mortgages

- Seller Financing or a Seller Carry-back

- Private Equity Firms

- Family or Friends

Ultimately, when purchasing your replacement property, who you borrow from does not impact your exchange.

Legal and Tax Considerations when Acquiring Replacement Properties

These IRS requirements must be met to structure a delayed exchange.

In order to have a good exchange, the taxpayer(s) who previously held property need to do the following:

- Replace the value they relinquished (less non-recurring closing costs) AND do the following:

- Utilize all exchange funds

- Replace any debt

- Acquire title as the same taxpayer who relinquished property

Any debt not replaced and any cash leftover is considered boot and potentially taxable to the client regardless of the replacement property value. For example, over borrowing to purposely leave cash even though you met or exceeded the replacement value still means the cash boot is subject to tax.

If a partial exchange takes place where the taxpayer either wasn’t able or made the choice to buy down in value they are just responsible for taxes on the value they did not replace. In scenarios where this might be applicable we strongly encourage have your tax counsel involved throughout your exchange to ensure you are fully aware of any tax consequences.

In the event of a failed exchange where no properties were purchased the taxpayer would be responsible for taxes as if they had a traditional sale transaction. There is no penalty for attempting an exchange.

Case Study

In this real-world examples of a successful replacement property acquisition, we highlight the strategies that were applied.

A client, we can call Bonnie for the purposes of anonymity, sold a property in Rolling Hills, CA.

Sales Price: 4,480,000.00

Debt: 262,272.34

Bonnie decided to diversify and purchase multiple replacement properties to satisfy her exchange.

Property 1: $905,205

Property 2: $1,099,000

Property 3: $1,350,000

Property 4: $965,000 with new debt of $346,000

Total replacement value: $4,319,205.00

It may appear as those Bonnie has tax liability on the difference, an estimated $160,795.00 but in reality, that can be reduced by the non-recurring closing costs from her relinquished property, where the commissions alone were over $250k. She did have less than $1,000 in cash boot, (which is not uncommon) that her CPA will potentially assess taxes on or net out against other costs but either way that is minimal.

We congratulate Bonnie on her successful exchange!

Conclusion

There is no “one size fits all”. Assemble a team of experienced advisors (realtors and tax professionals) and have a top notch qualified intermediary, like Exchange Resources. Then talk with our team about your plan and your goals and remember the 1031 exchange is a tool. Use this tool to grow and diversify your portfolio to meet whatever your current needs are.

Additional Resources

IRS 1031 Exchange Fact Sheet: https://www.irs.gov/pub/irs-news/fs-08-18.pdf